Amazon earnings reaction & data

According to the principal analyst Andrew Lipsman:

“This was a tough quarter for Amazon with trends across every key area of the business heading in the wrong direction and a weak outlook for Q2,” said Andrew Lipsman.

“The struggles begin with the commerce business, which couldn’t reverse the softening growth of recent quarters and even went negative. That created a drag on subscription and seller services revenue, and more importantly weighed on growth rates for its high-margin ad business.

Tapering topline growth in AWS following several quarters of acceleration is another concern, though improving profitability in the segment is a bright spot. Bottom line: Amazon will need to find a way to recharge growth in its commerce business in the coming quarters–don’t be surprised if Amazon hosts a second Prime Day this year in October to generate incremental revenues.”

AMAZON ECOMMERCE SALES

Worldwide

- In 2022, Amazon’s worldwide ecommerce sales will grow nearly 17.2% to $693.02 billion. That gives Amazon a 12.5% share of the global ecommerce market.

- Marketplace: 64.5% of Amazon’s ecommerce sales, with that share growing.

- Direct: 35.5% of Amazon’s ecommerce sales, with that share declining.

US

- This year, Amazon’s US ecommerce sales will grow nearly 14.6% to $408.19 billion. That gives Amazon a 39.5% share of the global ecommerce market.

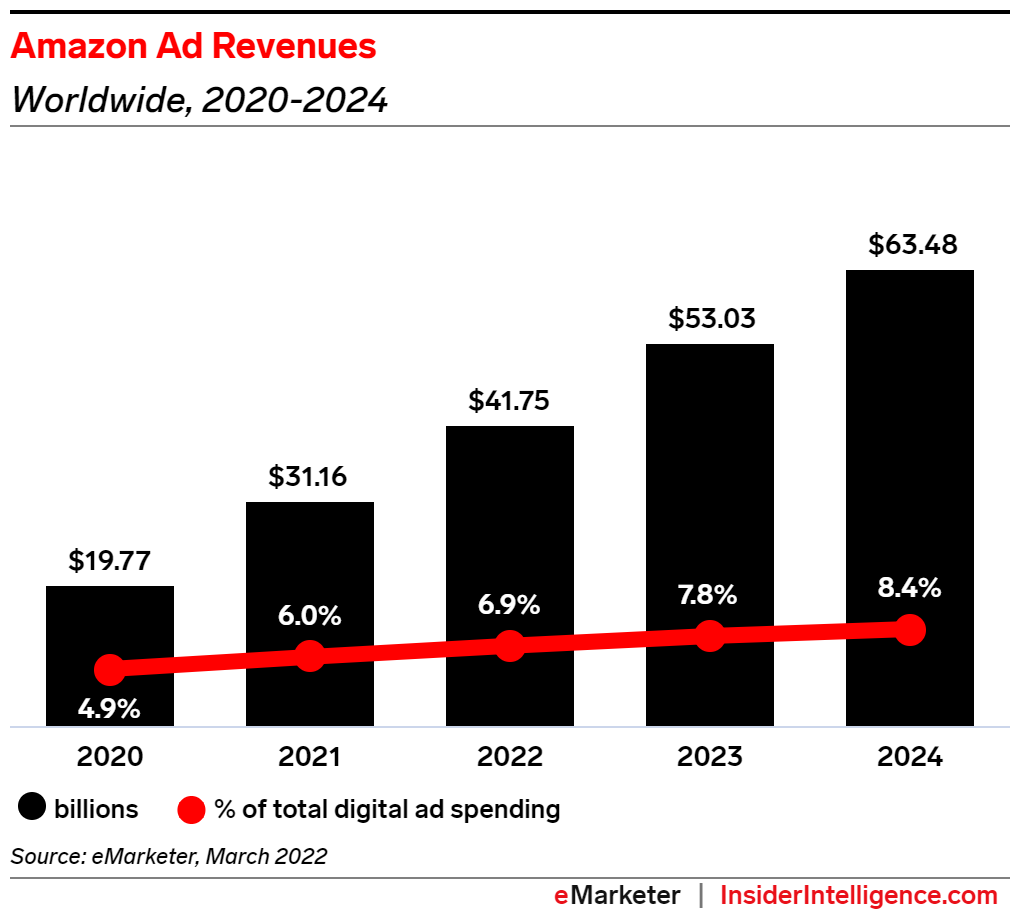

AMAZON WORLDWIDE AD REVENUE

Worldwide

- Amazon’s global ad business will grow 34.0% this year to reach $41.74 billion. That gives Amazon a 6.9% share of the global digital ad market.

- In 2022, 42.1% of Amazon’s worldwide ad business will come from mobile.

See more: Latin America faces unusually high risks

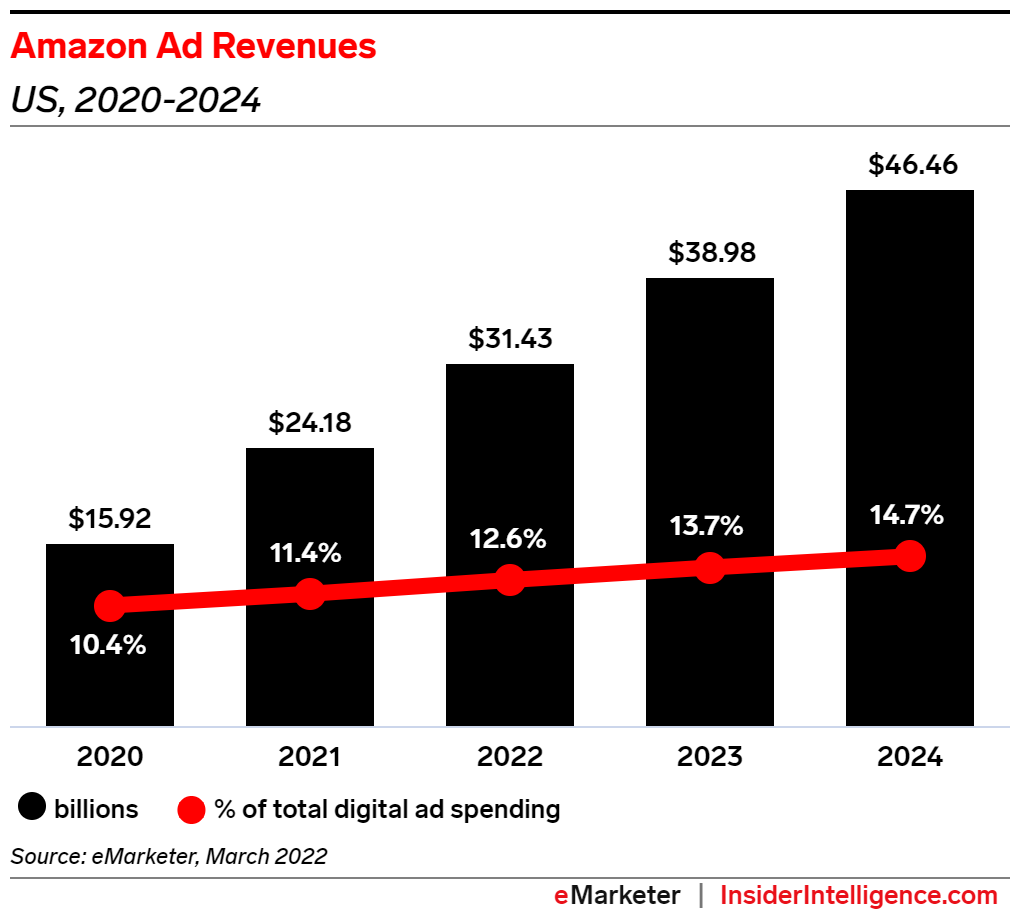

US

- Amazon’s US ad business will grow 30.0% this year to reach $31.43 billion. That gives Amazon a 12.6% share of the US digital ad market.

- In 2021, 49.0% of Amazon’s worldwide ad business will come from mobile.

Methodology

Insider Intelligence’s forecasts and estimates are based on an analysis of quantitative and qualitative data from research firms, government agencies, media firms and public companies, plus interviews with top executives at publishers, ad buyers and agencies. Data is weighted based on methodology and soundness. Each forecast fits within the larger matrix of all its forecasts, with the same assumptions and general framework used to project figures in a wide variety of areas. Regular re-evaluation of available data means the forecasts reflect the latest business developments, technology trends and economic changes.