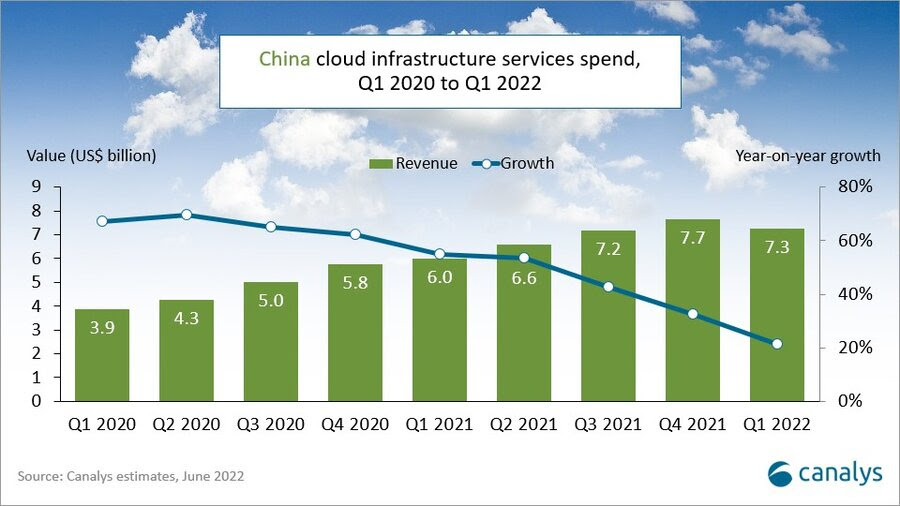

Cloud services spend in China hits US$7.3 billion in Q1 2022

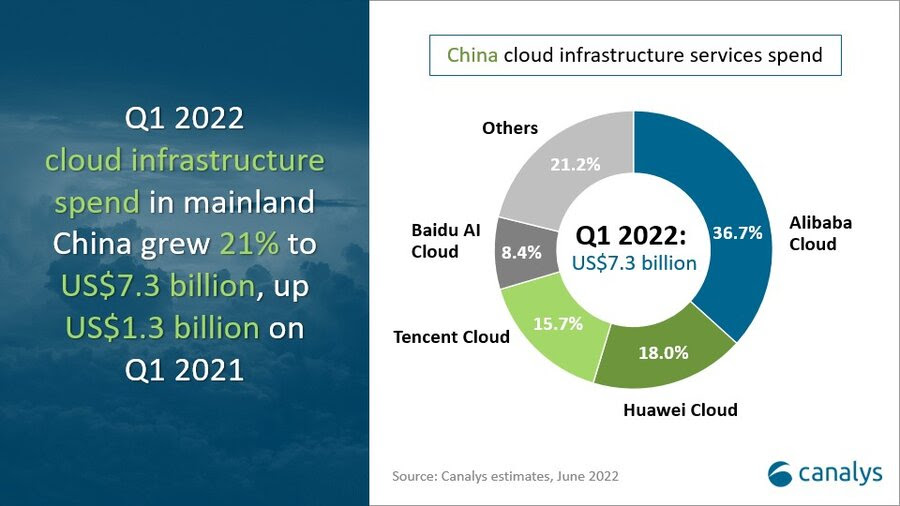

Cloud infrastructure services expenditure in mainland China grew 21% year on year to reach US$7.3 billion in Q1 2022, US$1.3 billion more than in Q1 2021, and 13% of global cloud infrastructure spend. Though spending was below expectations, China continues to be the leading growth market. Since March 2022, a resurgence of COVID-19 has hampered the delivery of both new and ongoing projects, resulting in a dampening of overall revenue in the Chinese cloud infrastructure services market. But with accelerated deployments due to China’s New Infrastructure plan and the increasingly urgent need for the digital transformation of enterprises, cloud service providers are still capturing new opportunities for their infrastructure services. The market leaders in China remained unchanged in Q1 2022, with the top four cloud service vendors being Alibaba Cloud, Huawei Cloud, Tencent Cloud and Baidu AI Cloud. The top four providers have benefited from the expansion of cloud use and accounted for 79% of total expenditure in China, an increase of 19% year on year.

The negative impact of the resurgence of COVID-19 on overall spending on cloud services is temporary. The pandemic has changed the long-term business model for most enterprises, with more organizations relying on ecommerce and remote working to complete transactions. Coupled with policy guidance in China, the urgency for enterprises to migrate to the cloud is higher than ever. The difference in service capabilities among the cloud service providers is shrinking, leading to a state of “involution” and accelerating competition. In response to this dynamic, China’s cloud titans are enhancing their abilities to combine specific industry experience with cloud services by developing their service ecosystems, focusing on those partners with experience in key verticals.

“Cloud has become a popular choice for IT enterprises and cloud services are moving up the stack from data center offerings to more industry-specific solutions,” said Canalys Research Analyst Yi Zhang. “Strategies of multi-cloud deployments and multi-service provider delivery are common in the market, and cloud vendors and ISVs from vertical industries are increasingly looking to build more flexible portfolios.”

See more: Japan’s digitalization can add momentum for economic rebound

“Currently, China’s hyperscalers are rapidly expanding their abilities to provide solutions for specific industry customers,” said Canalys VP Alex Smith. “But they are not doing this alone. Instead, they are growing their bases of specialized ecosystem partners across different vertical industries to achieve both technical and industry-specific problem-solving capabilities.”

- Alibaba Cloud continued to lead the cloud infrastructure services market in Q1 2022, accounting for 36.7% of total spend, an increase of 12% year on year. Alibaba Cloud is China’s perennial market share leader, and it continues to grow. Its overseas expansion is proceeding as planned, with Alibaba having announced the official opening of its data center in South Korea on 30 March 2022. It has also further developed its service ecosystem, announcing that 31 companies have joined its Cloud Native Accelerator Program, covering manufacturing, retail, healthcare and other key verticals.

- Huawei Cloud was the second-largest cloud service provider in Q1, growing 11% to take an 18.0% market share. It has won the cooperation of more than 100 enterprises through ecological integration with Huawei’s terminal business (PCs, smartphones and IoT) since it launched its “cloud-to-cloud collaboration” strategy last year. Huawei Cloud announced it will expand the business model of ecological integration of Huawei Cloud and the terminal business to more scenarios in 2022, including the integration of Huawei Cloud and IT Cloud, and the integration of Huawei Cloud and third parties. With the increase in ecological partners, Huawei Cloud is also growing its new Cloud Partner Program, which will reclassify partners into eight roles, each of which will have different training schedules and resourcing.

- Tencent Cloud, the third-largest provider, accounted for 15.7% of the market. Tencent Cloud’s revenue fell slightly this quarter compared with the previous quarter, mainly due to its internal business restructuring and changes to its growth strategy. Its new focus will be on purposefully playing to its strengths and increasing the adoption rate of its cloud products by preferring to sign orders in which self-developed products account for a high percentage. 2022 saw a gradual shift in Tencent Cloud’s strategic focus toward profitable growth rather than business volume growth, which will effectively improve the health of business development in the long term but will negatively impact revenue growth. This quarter, Tencent Cloud’s revenue was mainly from the creative, retailing and gaming industries, as its experience in pan-entertainment industries gives it a competitive advantage.

- The fourth provider, Baidu AI Cloud, accounted for 8.4% of the market and grew by 43%. With the differential advantages of combining cloud services with AI technology, alongside continued substantial investment in its business, it maintained high growth this quarter. In addition to the steady growth of revenue from the financial sector, Baidu AI Cloud is increasing its adoption rate in manufacturing, water supply and energy through its Kaiwu Industrial Internet Platform. The platform intelligently applies business experience to industrial models through AI technology and is now in use in 16 regions with more than 300 enterprises. For the acquisition of Internet-related customers, Baidu AI Cloud benefited from companies deploying a multi-cloud strategy, and also focused on expanding its reach into SMBs to increase market share.

Canalys defines cloud infrastructure services as services that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly but includes revenue generated from the infrastructure services being consumed to host and operate them.