Reputation matters for on-chain lending

Lending within DeFi has shown enormous potential. Taking place on the blockchain, it can provide increased transparency, lower fees, and worldwide access, and the community has taken notice.

According to data from DeFi pulse, as of March 2023, there are around 220,000 active borrowers and 840,000 active lenders on DeFi lending and borrowing platforms. The space has increased from $1 billion in total value locked in 2019 to over $120 billion in March 2023.

With many DeFi lending protocols relying on smart contracts for execution, there is also the promise of lending without the risk of human errors and default. Community participants proudly state, “The only people who received money from Celsius are those who borrowed through smart contract protocols.”

While the idea of a trustless, transparent lending system that spreads across borders and helps financial inclusion is wonderful, it is yet to go mainstream. Facing UX challenges, reputational limitations, and trust issues, despite its promise, it still may have a long way to go. Approaching the issue of on-chain identity to allow for under-collateralized lending could, however, supercharge adoption.

Collateral limitations

Given the past year’s events, the sector is perhaps forgiven for not yet realizing mainstream growth. With the names Celsius and FTX now sending shivers through the spine of anyone remotely interested in DeFi, the reputation of centralized lending in the space has taken a significant blow.

Centralized lenders have an advantage. Individuals can deposit currency for yield and take out overcollateralized loans like a bank working with fiat currency. The terms usually favor traditional finance and allow digital asset holders to keep their crypto. Institutional borrowers can also engage, taking out large loans for investment – the failing piece of more than one casualty last year.

The engagement with a centralized lender is familiar; many turn to them as a more attractive way to take out a loan on their digital assets.

However, companies often do not embrace transparency, and instances of allegedly fraudulent practices made public last year has left many questioning the remaining companies working with the space.

“I think for specific types of individuals…DeFi offers value propositions that CeFi (Centralized Finance) will never build,” said Nathan Cha, Marketing Lead of Dydx, at Consensus 2023.

“I think the specific goals of CeFi versus DeFi should be differentiated…I think recently, we’ve seen this difference play out very clearly too,” he said, explaining that centralized entities had tried to create solutions to counter consumer doubt, but “I don’t think they actually really solve the underlying issues that we’re seeing in CeFi that DeFi uniquely solves.”

While the DeFi ecosystem has decentralized lending marketplaces on public blockchains that have successfully ridden the waves of volatility, they have limitations.

Working for the most part within a peer-to-peer setup, individuals can offer assets up as collateral to then take out a loan. Others can grant the requested loan, either individually or in a pool, baking the collateral into a smart contract that will then carry out processes according to whether payments are made according to the initial agreement.

Processes are transparent and powered solely by smart contracts, allowing individuals to collaborate without a need for trust. However, the peer-to-peer setup requires a level of demand and supply from individuals on the platform, leaving the possibility that a loan may not be taken. In addition, collateral that matches or surpasses the requested loan in value is vital. This can leave the space inaccessible to many or limited to much smaller-sized loans.

Underwriting for on-chain lending

While the DeFi space was created initially to work as a trustless, anonymous system, increasingly, innovators are starting to see the benefit of some level of identification. However, current solutions do require a level of centralization.

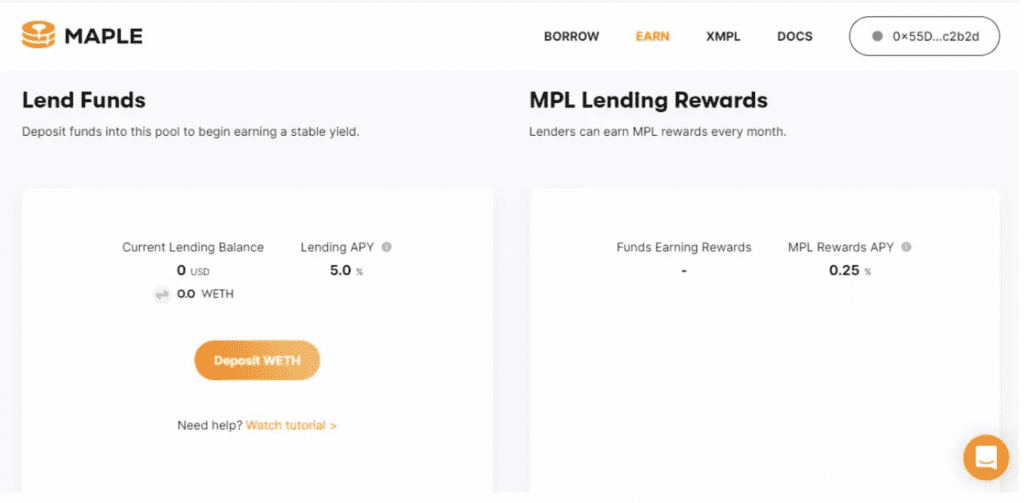

Maple is a blockchain-based lending platform that creates a space to form a lending pool that involves multiple individuals and businesses that want to lend on the blockchain. The focus of the loans is in the B2B space, and the company has introduced underwriting processes that allow businesses to borrow based on little to no collateral.

“It’s a way for people in the lending and banking sector to lower the cost of running their business,” said Sidney Powell, CEO and Co-founder of Maple. “You could run a comparable lending footprint in traditional finance (TradFi)…with half of the operational staff.”

Requesting institutions submit financial information within their application for a loan, which is then assessed by Maple and the participants in the pool before being approved.

“We started in peer-to-peer lending…but realized this is not going to scale,” said Powell. He explained that despite receiving repayments for all the loans made in the peer-to-peer space, the trustless environment made the risk level difficult to make large loans.

“So we did this model where instead of doing a peer-to-peer loan, we do a peer-to-pool loan, where we pool the funds,” he continued. “This was a lesson we were picking up from DeFi…we effectively created a syndicate, a credit fund on-chain, where a borrower can always come and talk to the delegate who manages the pool.”

“They’ll always know if they show documentation and that they’re profitable, then they can negotiate a loan at a certain price.”

This allowed the company to scale, granting large under-collateralized loans that were impossible within the peer-to-peer environment.

“Maple’s done about $2 billion in loans today. Almost all of that was uncollateralized,” said Powell, explaining that having access to financials allowed them to underwrite, removing a need for collateral.

However, he explained that businesses were an easier focus for this approach due to additional regulatory constraints and a need for a collections department in the case of a default.

“One of the promises of doing consumer lending on-chain is that if you can see their wallet history, it’s a much faster process to underwrite them,” continued Powell. “In consumer lending, your FICO score records every time you miss a payment. It doesn’t record the 100 payments that you made on time. Whereas on the blockchain, you can see all the payments that you’ve ever made on time as well as the ones you miss. So it gives a more complete picture.”

Reputational lending could be the next step for DeFi

The ability to underwrite on-chain could also allow consumers to borrow across borders, opening access to credit.

“I think that the cornerstone to crypto markets is the notion of sort of peer interaction,” said Andrew Keys, Co-founder and Managing Partner of Darma Capital at Consensus 2023.

“For us, as an ecosystem, to move towards reputational-based lending, versus overcollateralized based lending, where only the rich are going to be able to engage in the lending markets, I think that one key point is having large representational attributes through self-sovereign identity and then being able to borrow based on his reputational attributes similar to a credit score in today’s day and age.”

Both inside and outside of the crypto ecosystem, new forms of digital identity are being created that attempt to balance a need for individual privacy on-chain with the benefits reputation and historical records of an individual can bring to finance.